DiNapoli: Tax Cap Remains at 2% for 2026

July 15, 2025

The 2026 property tax levy growth will be capped at 2% for local governments that operate on a calendar-based fiscal year, according to data released today by State Comptroller Thomas P. DiNapoli. This figure affects tax cap calculations for all counties, towns, and fire districts, as well as 44 cities and 13 villages.

“Allowable tax levy growth will be limited to 2% for a fifth consecutive year,” DiNapoli said. “The challenge for local governments will be maintaining essential local services within this cap, while still dealing with higher prices for commodities and services and the potential impact of policy choices at the federal level.”

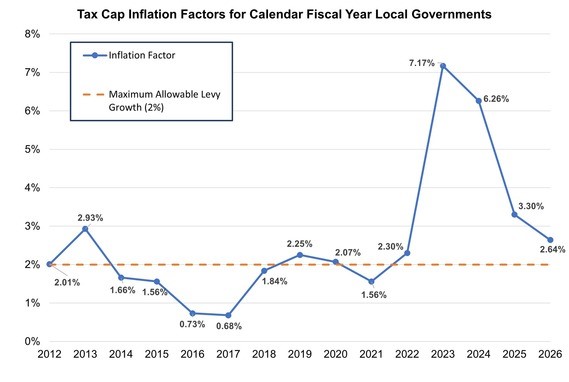

In accordance with state law, DiNapoli’s office calculated the 2026 inflation factor at 2.64% for those local governments with a calendar fiscal year, above the 2% allowable levy increase.

The tax cap, which first applied to local governments (excluding New York City) and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2% with certain exceptions. The law also includes a provision that allows municipalities to override the cap.

Chart

Allowable Tax Levy Growth Factors for Local Governments

Posted: July 15th, 2025 under General News, Northern NY News, Peru/Regional History, State Government News, Town Board News.