Beginning 12 a.m. Sunday, All Commercial Vehicles Required to Travel Exclusively in the Right Travel Lane on All State Roads, including the New York State Thruway

At Governor Hochul’s Direction, State of Emergency Remains in Place Statewide

New Yorkers Can Sign Up for Weather and Emergency Alerts by Texting 333111

January 24, NYS News Release – Governor Kathy Hochul today updated New Yorkers on state preparations ahead of a massive winter storm system that has already brought bitterly cold temperatures to the entire state and is expected to bring at least a foot of snow to the majority of the state. Following the Governor’s declaration of a State of Emergency and activation of 100 members of the New York National Guard on Friday, new travel restrictions for commercial vehicles are being implemented. Beginning at 12 a.m. Sunday, all commercial vehicles will be restricted to only traveling in the right travel lane on all state roads, including the New York State Thruway. Additionally, a travel ban for Long Combination Tandem Vehicles will be in place on the New York State Thruway beginning at 6 a.m. on Sunday.

“New Yorkers know how to handle winter, but it’s critical everyone treat this weather like the dangerous situation it is,” Governor Hochul said. “From bitterly cold temperatures to heavy snowfall that will create treacherous travel conditions, there is no shortage of risks to being outside or traveling during the next few days, so I am urging everyone to be smart and stay home, stay warm, and stay safe.”

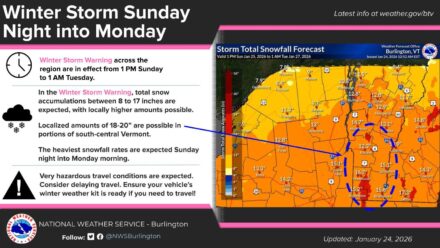

The storm is expected to begin impacting the southernmost portions of the state in the early morning hours and then progressively move north to cover the entire state by late morning and early afternoon hours. It is expected to continue until Monday afternoon, with everywhere north of New York City expected to see between 12 and 18 inches of snow, except for Western New York and the northernmost portions of the North Country which may only see 8 to 12 inches of snow. Beginning Sunday evening, there is a chance that snow may transition into sleet in New York City and on Long Island which has slightly decreased the projected snow totals in those areas to the 8-to-12-inch range. Peak wind gusts could reach 35+miles per hour in these downstate areas as well, which will increase the potential for some blowing snow and whiteout conditions, adding to the already treacherous travel conditions expected throughout the duration of the storm.

To support Downstate response operations and local partners, Governor Hochul activated 100 service members of the New York National Guard with 24 vehicles on Friday. Beginning Saturday, they will be staged and ready to help local partners across New York City, Long Island, and the Lower Hudson Valley.

Additionally, as part of the State of Emergency declared by the Governor on Friday, early voting for February 3rd special elections in New York City will be suspended on Sunday, January 25 and Monday, January 26. The State is working with the New York City Board of Elections to extend hours through the remainder of the early voting period to account for the suspended hours.

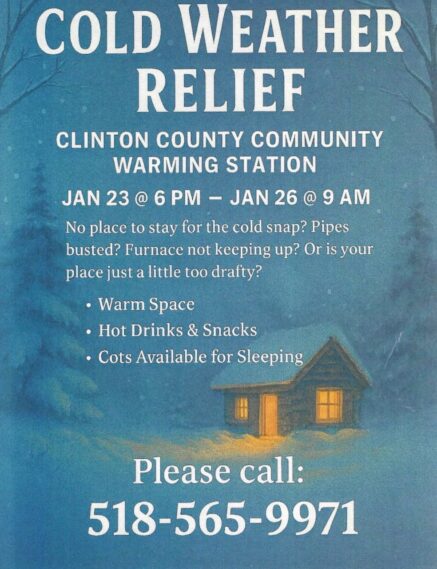

In addition to preparing for snow and wind, New Yorkers should also prepare to protect against the dangers that can result from colder weather and winter activities. Under state regulation, a Code Blue is automatically in effect whenever the temperature and wind chill equal less than 32 degrees. Local social services districts are legally required to take necessary steps to ensure those experiencing homelessness have access to shelter and that shelter hours are extended. New Yorkers also should check out these cold weather tips from the Department of Health; additional tips for preventing frostbite and hypothermia; information on Carbon Monoxide poisoning; information on the proper use of generators; and safe winter driving tips.

The New York State Department of Labor advises workers and employers to engage in extreme cold weather best practices such as:

- Limit outdoor work, provide frequent breaks in warm areas and schedule outdoor work during the warmest times of the day.

- Ensure access to clean drinking water.

- Stay hydrated with warm beverages and avoid drinking caffeine.

- Wear proper PPE, including at least three layers of clothing, gloves or mittens, thick socks, insulated footwear and a hat, hood or hard hat liner.

View more information on best practices for working in cold weather.

Extreme Cold Watches, Winter Storm Warnings and Winter Weather Advisories have been issued, and New Yorkers should closely monitor their local forecasts and look for updates issued by the National Weather Service. For a complete listing of weather alerts, visit the National Weather Service website.

New Yorkers should also ensure that government emergency alerts are enabled on their mobile phones. They should also sign up for real-time weather and emergency alerts that will be texted to their phones by texting their county or borough name to 333111.

Agency Preparations

Division of Homeland Security and Emergency Services

The Division’s Office of Emergency Management is in contact with its local counterparts and is prepared to facilitate any local requests for assistance. State stockpiles are ready to deploy emergency response assets and supplies as needed. The State Emergency Operations Center will be activated beginning Saturday night and the State Watch Center, New York’s 24/7 alert and warning hub, is monitoring the storm track and statewide impacts closely. The State Fire Operations Center has also been activated.

Department of Transportation

Beginning at midnight tonight, all commercial vehicles will be required to travel exclusively in the right travel lane on all state roads across New York, including the New York State Thruway. Ongoing coordination is continuing with New York State Police, the Thruway Authority, and adjacent states with their own travel restrictions in place.

Regional crews in impacted areas are currently engaged in snow and ice operations and preparations. All residency locations will remain staffed 24/7 throughout the duration of the event and priority cleanup operations. Fleet mechanics in affected areas will be staffing all main residency locations 24/7 to perform repairs and keep trucks on the road.

Nearly 3,700 supervisors and operators are available statewide and are prepared to respond. Staffing in most-affected regions is broken down as follows:

- Mid-Hudson: 558 supervisors and operators

- Long Island: 382 supervisors and operators

Staff can be configured into any type of response crew that is needed (plow, drainage, chipper, load & haul, cut & toss, etc.). 75 Incident Command System personnel are available to support the ICS response to this event.

To support response activities in critical areas, a total of 90 staff, including 72 plow truck operators, 4 supervisors, 6 equipment operator instructors, 2 safety representatives and 6 service technicians; and 2 snow blowers are being deployed. They will be deployed as follows:

-Receiving 2 equipment operator instructors from the Finger Lakes

-Receiving 1 safety representative the Finger Lakes

-Receiving 12 operators and 4 equipment operator instructors from Western NY

-Receiving 8 operators from the Western So. Tier

-Receiving 1 safety representative from the North Country

-Receiving 8 operators, 1 service technician, and 1 snow blower from the Capital Region

-Receiving 14 operators, 1 service technician, and 1 snow blower from the Mohawk Valley

-Receiving 8 operators, 1 supervisor, and 2 service technicians from Central NY

-Receiving 6 operators from the Finger Lakes

-Receiving 10 operators and 2 supervisors from the North Country

-Receiving 6 operators, 1 supervisor, and 2 service technicians from the Eastern So. Tier

All staff are currently in travel mode and will be in place by Saturday evening. The need for additional resources (operators, trucks, mechanics, equipment operator instructors) will be constantly re-evaluated as conditions warrant throughout the event.

All available snow and ice equipment is ready to deploy. Statewide equipment numbers are as follows:

- 1629 large plow trucks (Mid-Hudson: 254, Long Island: 248)

- 149 medium duty plows (Mid-Hudson: 33, Long Island: 17)

- 53 tow plows (Mid-Hudson: 4, Long Island: 1)

- 336 large loaders (Mid-Hudson: 51, Long Island: 36)

- 37 snow blowers (Mid-Hudson: 1, Long Island: 1)

Adequate salt is on hand. Parks and DEC have identified a total of 10 crews to be available for cut and toss missions, if needed. Two Crews will be available in each of the following locations: Southern Tier, Central NY, Capital District, Mid-Hudson, and Long Island. All crews will be on standby starting at noon on Sunday and will remain on standby through COB Tuesday.

Generator stockpiles are being readied to support dark signals. An additional 40 generators are available to support possible needs on Long Island. Additionally, the Department is repositioning a trailer with 25 generators from the Capital Region to the Hudson Valley Region for additional support should it be needed for supporting dark signals. New Yorkers are reminded to treat dark traffic signals as an all-way stop.

Tow services will be provided in the following locations: US 20 (Madison), I-81 (Onondaga), I-390 (Steuben), I-86 (Chemung), NY 36 (Steuben), I-86 (Tioga), I-84 (Putnam), I-84 (Orange), I-684 (Putnam), I-81 (Broome), I-88 (Broome), NY 17 (Broome), I-86 (Broome), NY 206 (Delaware), NY 28 (Delaware), I-495 (Nassau – multiple), and I-495 (Suffolk – multiple). The need for additional tow trucks will be evaluated as the event develops. Additionally, HELP truck beats will be extended in impacted areas.

Department staff is available to support County EOCs as needed for Incident Command System support.

Weather related messages on variable message signs began on Saturday morning in all impacted locations. Messaging will also be used to support real time incidents and vehicle restrictions throughout the event.

For real-time travel information, motorists should call 511 or visit www.511ny.org/, New York State’s official traffic and travel information source.

The need for additional resources will be re-evaluated as conditions warrant throughout the event. For real-time travel information, motorists should call 511 or visit www.511ny.org/, New York State’s official traffic and travel information source.

Thruway Authority

A right lane only restriction on all commercial vehicles will go into effect at 12 a.m. Sunday, January 25 on all state highways including the Thruway system.

Additionally, all Long Combination Tandems (LCV) vehicles will be banned from traveling on the entire Thruway System, including I-87, I-90, I-287, I-190, and the Berkshire Spur, beginning at 6 a.m., Sunday, January 25.

The Thruway Authority is ready to respond with 685 operators and supervisors available.Statewide equipment numbers and resources are listed below:

- 333 large and medium duty plow trucks

- 11 tow plows

- 62 loaders

- 114,000+ tons of salt on hand

Variable Message Signs and social media (X and Facebook) are utilized to alert motorists of winter weather conditions on the Thruway. Read more »

Call Meeting to Order

Call Meeting to Order Extreme Cold Watches in Effect from 7 p.m. Friday to 1 p.m. Saturday for the North Country; Feels-Like Temperatures as Low as Negative 50 Degrees Possible Friday Night and Negative 30 Degrees Saturday Night

Extreme Cold Watches in Effect from 7 p.m. Friday to 1 p.m. Saturday for the North Country; Feels-Like Temperatures as Low as Negative 50 Degrees Possible Friday Night and Negative 30 Degrees Saturday Night Support North Country’s Health, Wellbeing

Support North Country’s Health, Wellbeing The Peru Central School District is officially seeking candidates to fill two (2) at-large seats on the Board of Education. These vacancies result from the upcoming term expiration of Mr. Mark Hamilton and the resignation of Ms. Sarah Mitchell, which is currently filled by Mr. Steven Peters.

The Peru Central School District is officially seeking candidates to fill two (2) at-large seats on the Board of Education. These vacancies result from the upcoming term expiration of Mr. Mark Hamilton and the resignation of Ms. Sarah Mitchell, which is currently filled by Mr. Steven Peters.

By John T Ryan

By John T Ryan